A receipt of payment is proof of payment that confirms that the transaction is completed. It includes details of the purchases, including the payment date and the amount paid.

A payment receipt is important to track finances, provide proof of payment, and avoid payment disputes.

There are many ways businesses can create receipts online and offline, including handwritten, printed, email, or mobile receipts.

When running a business, you would have to purchase goods or services from a supplier. Once the transaction is completed and you have paid the invoice, you should receive a document that proves your payment. That document is a receipt, which is also referred to as a receipt of payment or payment receipt.

In this article, we'll explore the essential information about payment receipt, from what it is to why it is necessary and how to create one. We’ll also cover how to send receipts to your customers so that you get a clear understanding of how they work.

A receipt is a document that the seller issues as proof of payment to the buyer or the customer. It confirms that the seller has received the amount due for the products or services sold, and it is normally provided after the transaction is finalized.

Historically, humans have been using receipts to record transactions since more than 5,000 years ago, according to The American Numismatic Society. Between Mesopotamian merchants and 21st-century online vendors, proof of payments was created in many forms. In the present day, businesses normally issue receipts on a sheet of paper or digitally.

Receipts can also be issued when deposits or partial payments are made toward goods or services.

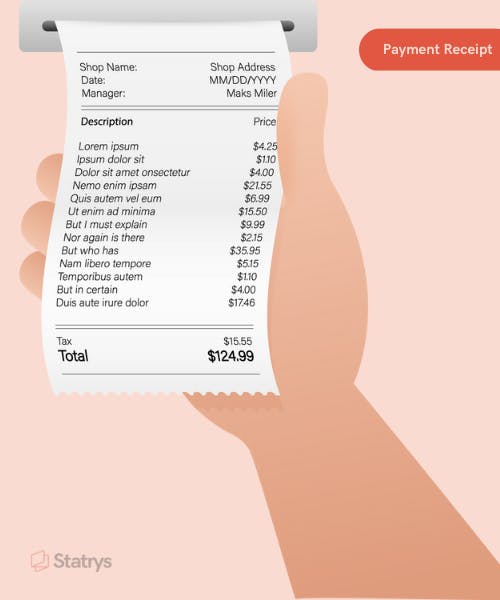

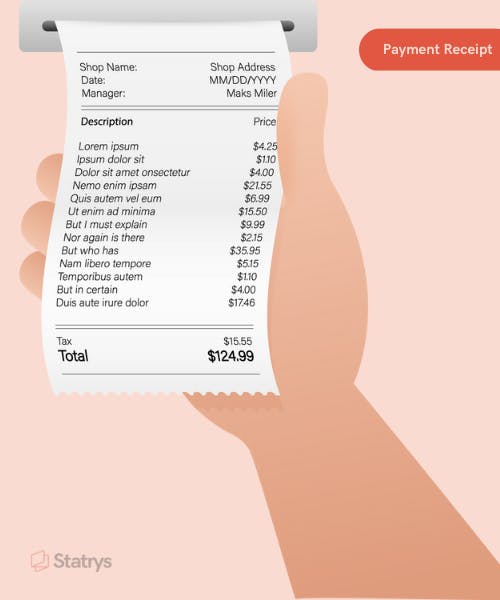

Here’s an illustration of what a receipt of payment looks like:

A receipt is not the same as an invoice, and it cannot be used interchangeably.

While a receipt confirms that the seller has received the payment, an invoice is a formal document that informs the customer of the outstanding amount to be paid. The primary purpose of an invoice is to collect payments.

The main difference between an invoice and a receipt is the timing and the purpose of issue:

Both an invoice and a receipt are equally important documents for your business's accounting process. Understanding the differences between them enhances efficient financial and cash flow management.

💡 Tip: If a payment receipt is attached to a particular invoice, then the invoice number should be included on the receipt. Additionally, if the invoice has been fully paid, it's beneficial to state "Invoice Paid" on the receipt to avoid misunderstandings.

A receipt of payment is proof that there was a sales transaction between the seller and the buyer. It is important as it not only records the terms of sales but also provides evidence of the completion of the transaction.

As a seller, keeping a copy of a receipt for every transaction helps keep track of your income and expenses, allowing you to maintain an accurate financial record and inventory. As a buyer, receipts can also be used in accounting to calculate expenses.

Let's look at how a payment receipt is essential from the perspective of the business and the customer.

Keeping a record of all receipts of payment is important for accounting purposes in every business. Payment receipts can record all business purchases made throughout a given tax year and beyond.

When it's time to lodge your tax declaration, a record of receipts makes it easier to work out the total spent on business-type purchases while ensuring that upon request from the relevant tax authorities, you can provide proof of any claims you make towards tax deductions.

If you're being audited by the IRS in the US, you might be requested to provide records of receipts related to your business.

As a business, issuing a copy of a payment receipt provides transparency for the transaction, enhancing customer trust and making your business more professional.

As a startup owner, businesses need receipts primarily for record-keeping and tax purposes. They serve as proof of transactions, making it easier to track income and expenses.

David Rubie-Todd Co-founder and Marketing Director, Sticker ItDo you always issue payment receipts?

Yes, I always issue payment receipts. As a customer myself, I wouldn't feel good if I didn't receive an official receipt from the establishment. With the approach of issuing payment receipts, we maintain customer trust and transparency.

Do you always keep receipts?

I always keep receipts without exception. They're crucial for verifying expenses, especially during tax season. Additionally, they can serve as a backup in case of lost digital records. Furthermore, I also make it a habit to regularly review and organize receipts for easy reference in the future.

How do receipts help in your business?

They aid in budgeting, financial planning, and also in case of any disputes. For instance, some institutions require tax certificates when you're applying for loans, which requires a detailed record of your income and expenses. Having all your receipts makes this process smoother.

A valid copy of a payment receipt is essential when requesting refunds, exchanges, or warranty claims based on terms of sales, as it is proof that you have purchased the product from a specific business.

Keeping a consistent record of invoices can also help you maintain tangible evidence in case of disputes about the payment.

Payment receipts can also be useful for those who are budgeting and understanding how much they spend on average on goods and services.

💡Tip: Keeping an accurate record of invoices for 3-6 years is recommended, depending on different circumstances. In the USA, the IRS advises a 3-year period for most expenses.

Another significant use of a receipt is to maximize tax deductions. If you are a business owner, keeping track of all expenses for tax purposes is essential. When claiming deductions on your tax return, you must have documentation to support your claims, including receipts.

While bank or credit card statements can show the transaction amount, they are not considered adequate proof of a business expense.

It's crucial to retain the full sales receipt, which includes the date, the vendor's name, the items purchased, and the total amount paid. These details are necessary for your deduction to be allowed.

Each country has different regulations concerning whether it is mandatory for businesses to provide a receipt. Providing proof of purchase directly after completing the payment is recommended in most places. Let's take a look at some examples:

| Country | Regulations on receipts |

| Australia | It is not mandatory for businesses in Australia to provide sales receipts for goods or services valued at under 75 Australian dollars. However, businesses are obligated to provide a receipt if the customer requests it, regardless of the total cost. |

| Hong Kong | In Hong Kong, it is mandatory for retailers that are selling regulated goods to provide a receipt of payment. Retailers must also include specific product details on the receipt and/or invoice issued to the buyer. |

For businesses, if a customer asks for a receipt, it is common practice to oblige to this request. If you are doing international trade, paying attention to the consumer laws about payment receipts of the country where your customers reside is also essential.

It is also worth noting that regulations about payment receipts vary between industries. For example, companies such as appliance stores with warranty terms as quality assurance should always provide a receipt, as the date of payment is typically the beginning of the warranty period.

💡 Tip: If the payment is made through the SWIFT network, the customer can request an MT103 document as proof of a cross-border money transaction.

Having a receipt template ready to be issued is an excellent way to organize and streamline your financial management process. Here are 3 practical ways you could use to create a receipt for payment:

No matter how you create your receipt, you should provide the details about the transaction in a receipt of payment.

These are the essential information:

Under some circumstances, you can also include these details:

💡 Tip: Always be consistent with the format of your receipt to avoid confusion.

After issuing a receipt, the next step is to send it to your customer. For brick-and-mortar stores, a copy of the receipt could be handed to the customer immediately after the payment.

Here are some ways a business can send receipts to their customer.

This is a common way to provide paper receipts for customers at the point of sale. It has been the primary method of issuing payment receipts for most of the 20th century.

Some examples of offline proof of payment include:

For businesses in the ecommerce industry that mainly make virtual transactions, sending and storing online proof of payments is more efficient. This is particularly important as more consumers move towards online shopping and digital transactions.

For customers, digital receipts offer a convenient way to track purchases and manage personal finances. They can easily be stored and accessed on digital devices, reducing the need for physical storage and simplifying the process of tracking expenses over time.

Some examples of online proof of payment include:

A receipt of payment is an essential document that provides proof of a completed transaction. For both the business and the customer, keeping receipts is necessary to accurately keep track of incomes and expenses for financial management and tax purposes. It is also a tangible sales record that is usually required when processing refunds or warranty claims.

Statrys Invoicing Software